Showing 9 posts

Repo Rate Cut Cycle – Should You Choose Floating or Fixed Reset in 2025?

RBI expected to cut 50 bps by March-26. We model interest saving under floating vs 3-yr fixed-reset loan.

Repo Rate Cut Cycle – Floating vs Fixed Reset Strategy for Minimum Interest

RBI expected 50 bps cut by March-26, floating saves ₹1,650/month, hybrid strategy for rate optimization.

Joint Home Loan with Parent – Tax Rebate on ₹3.5 L Interest, Legal Checklist

Add earning parent as co-borrower; split interest ₹3.5 L each, total ₹7 L 80C benefit. We share ownership & repayment structures.

Joint Home Loan with Parent – ₹7 L Tax Rebate Strategy, Legal Framework

Add parent as co-borrower, split ₹3.5 L interest each, total ₹7 L 80C benefit, structure and documentation.

Home Loan Rates Dip Below 8% – Should You Refinance or Reset in October 2025?

SBI, HDFC slash repo-linked rates to 7.85%. We calculate savings on ₹80 L loan and list best switch options.

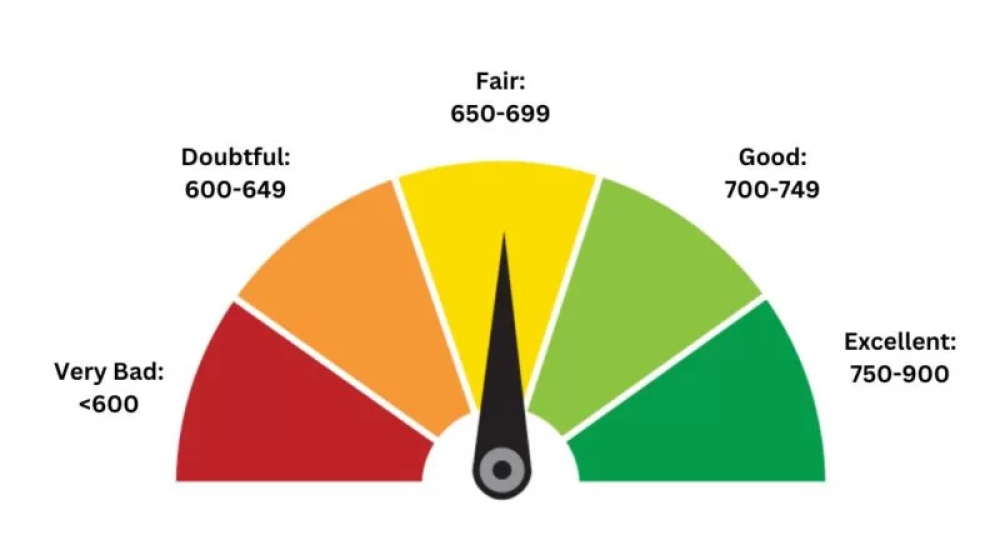

CIBIL Score 650? 5 Practical Steps to Boost Home Loan Eligibility in 6 Months

From secured cards to goodwill letters, we chart a 6-month action plan to lift score to 750+ and save 50 bps rate.

CIBIL Score 650 to 750 – 6-Month Action Plan for Better Home Loan Rates

Improve CIBIL from 650 to 750 in 6 months, save 50 bps on home loan rate, ₹6.8 L interest saving.

Top-Up Home Loan vs Personal Loan – Interest Gap 500 bps in October 2025

Top-up loan at 8.2% vs personal loan 13.5%. We compare processing time, tax benefit & prepay penalty.

Top-Up Loan vs Personal Loan – 500 bps Interest Rate Gap Favors Top-Up

Top-up loan 8.2% vs personal loan 13.5%, ₹10 L saves ₹2.7 L interest, renovation financing guide.