Joint Ownership vs SPV – Tax & Exit Implications for FriendsPooling Money

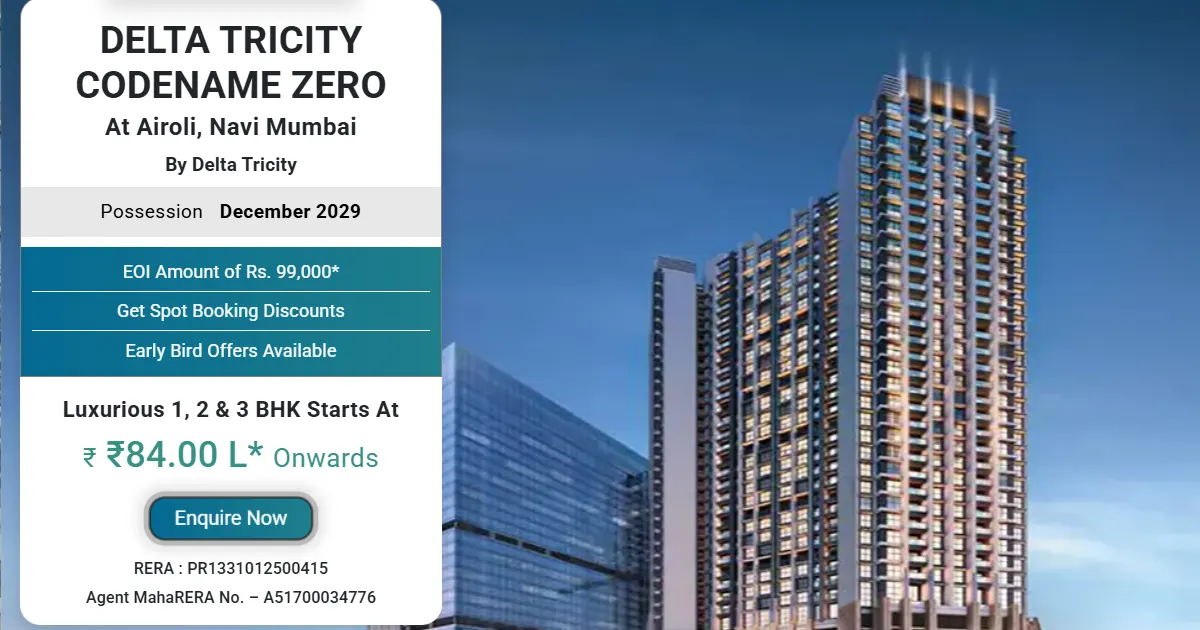

Four friends pooling ₹25 L each to buy a ₹1 Cr flat must decide between joint ownership and forming an LLP/SPV. Joint route: stamp-duty 6% (one-time), capital gains on individual share, easy exit via gift/sale but no limited liability. SPV route: 0.1% stamp-duty on share transfer, corporate tax 25%, dividend tax 10%, but exit is liquid and liability limited. We model 5-year IRR: joint ownership 11.8%, SPV 10.9% post-tax, but SPV scores on clean title & succession. Download decision matrix. Keywords: joint ownership tax, property LLP, friends invest together.

Comments (0)

Leave a Comment